TheOrganizedBear MBestimating From shop PaperBallards, ad by Evergreenstores Fixed expenses are expenses that dont change for long periods of time, like office rent or vehicle lease payments for you or your staff. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. Corporation Income Tax Return, Tax Write-Offs for the Owner of a Hair Salon. You may choose any recordkeeping system suited to your business that clearly shows your income and expenses. Keeping notes on receipts about how you intend to use a book can help in the event of an audit. Ad from shop ManjaSheets These documents contain the information you need to record in your books. Ad from shop DASspreadsheets ThePlannerRoom fiveandbright You should also consider listing office furniture here, as some of it may be tax-deductible depending on the cost. Other Questions Related to How to Categorize Expenses for Small Business: What Can I Write off for Business Expenses? From shop PremierTemplates, ad by PinkLabelsCo Can I Write off My Business Start up Costs?

expense ManjaSheets Books to help you with your business are all fully expensable! Professional Services are fees charged by individuals with training in a specific field, hired by your company to perform a service. 12.40, 12.57

expense binding recordkeeping

expense binding recordkeeping InspiredJournalsShop

What Is Burden Cost in Manufacturing and Why You Should Calculate It, Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting, A Simple Guide to Small Business Write Offs, 14 Small Business Expense Categories to Consider, Group Insurance (health, dental, life and disability), Education and Training (including conferences). It is important to keep these documents because they support the entries in your books and on your tax return. Office Expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, software, fax machine, printer, etc. 3927designs

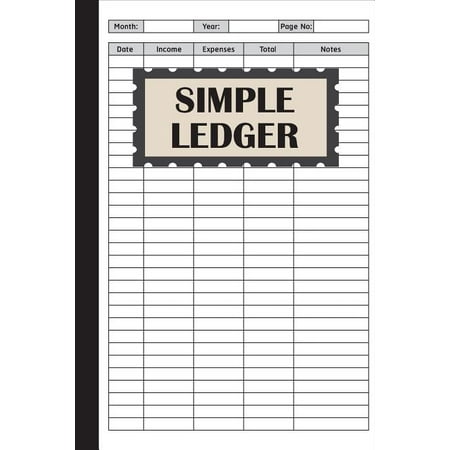

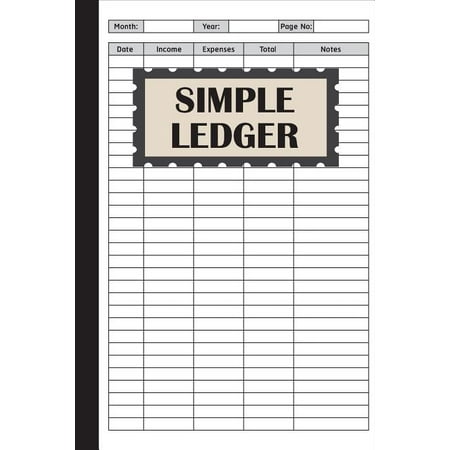

ledger accounting journal bookkeeping financial paper general simplified expense budgeting cash tax record tool sales simple report business pa enter Some of the technologies we use are necessary for critical functions like security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and to make the site work correctly for browsing and transactions. Ad from shop RADishPaperCo Ad from shop BoujeeSolutions Andy says: "This is an excellent practical guide to brand strategy and design.

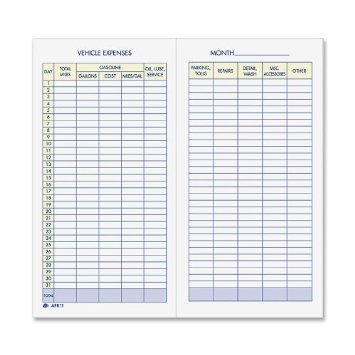

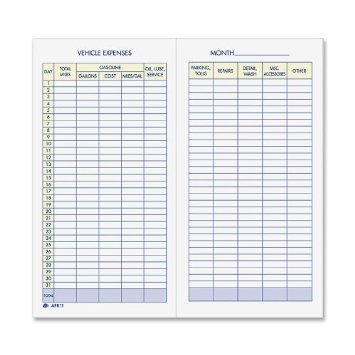

expense vehicle adams office 3.26, 3.00 SquizzleBerry A great client giveaway keeps clients organized and coming back. Her fiction has been published by Loose Id and Dreamspinner Press, among others.

(15% off), ad by formlay RebrandifiedStudio

Too often, creativity is assumed to be the domain only of 'creative types'. To learn about how we use your data, please Read our Privacy Policy. 3.31, 3.73 34.33, 33.12 You can claim a deduction for books, periodicals and digital information you use in earning your employment income. Ad from shop Meedas (20% off), ad by LYSAdigital Original Price 12.57

Original Price 11.43 Ad from shop SevenartKDP Will says: "You dont have to be a service designer to use design thinking in your business. From shop SevenartKDP, Sale Price 3.26

Ad from shop visuelstudioco This inspiring book from the founders of award-winning design firm IDEO shows how anyone, in any profession, can unlock their creative potential. Holiday parties are also an example of what would be considered entertainment. Youll want to see how much its costing your company just to manage it, which can help you develop cost-saving strategies for the future. (70% off), ad by TheDigitalBooktique Wed love your help. These benefits are designed by businesses to attract and retain talent. SouthernMessMommaCo LYSAdigital

Variable expenses change from month to month.

expense account record binding adams spiral inches clear RealEstateDesignCo

From shop 613Beauty, ad by UsefulPlanner

ledger business expense flip personal log bookkeeping Then check out the FreshBooks Resource Hub. With World Book Day upon us, I asked around the office for some book suggestions from the ANNA team. Got questions? Since they have a useful life of several years, the IRS requires such assets to be depreciated over a period of years. Depreciation is a tax deduction that allows you to recover the cost of any assets that you purchase and then use for your business. Itemized Lists for Tax Write-Offs for Business Expenses, Self Employment Tax Deductions for Hair Stylists, Internal Revenue Service Publication 535: Business Expenses, Internal Revenue Service: Publication 946 How to Depreciate Property, Internal Revenue Service Instructions for Schedule C, Internal Revenue Service Instructions for Form 1065 - U.S. Return of Partnership Income, Internal Revenue Service Instructions for Form 1120 - U.S. Tim says: "It's like the ultimate guide to extracting great ideas from yourself and your team. Ashlee Vance tells the intriguing story of entrepreneur and innovator Elon Musk, from his childhood in South Africa through his early ventures at Zip2 and PayPal, and on to global success with SpaceX, Tesla and SolarCity. Australian Taxation Office for the Commonwealth of Australia. From shop veeveebox, ad by HayeAmeri TheDigitalBooktique Ad from shop TrulyNeatPrintables Ad from shop PremierTemplates Ad from shop FrankyTemplateDesign JDaltoPhotography KAltureDelivery From shop KAltureDelivery, ad by PepperPrintable August has arrived with plenty of interesting destinations for the discerning summer readerfrom spooky offshore islands to an To see what your friends thought of this book, Accounting Ledger Book: Business Expense Tracker Notebook - Business Ledger for Small Business or Personal Use Simple Ledger Books for Bookkeeping, Readers' Most Anticipated Books of August. Please. Ad from shop formlay If your costs are organizational in nature (related to legal or incorporation fees), getting the business ready (for example, staff training) or research/investigation (product analysis), the IRS does allow for tax deductions. (70% off), ad by RebrandifiedStudio 7.57, 11.43 Great reference you can dip in and out of.". That doesnt mean your company car policy shouldnt support personal use, you will just want to figure a way to divide the charges between personal and business. Business supplies are tangible items like pens, paper, staplers, printer ink, and postage. Ad from shop InspiredJournalsShop If you need income tax advice please contact an accountant in your area. From shop HayeAmeri, ad by SouthernMessMommaCo Saying no will not stop you from seeing Etsy ads or impact Etsy's own personalisation technologies, but it may make the ads you see less relevant or more repetitive. formlay PaperBallards

This is clearly marked. From shop BloomSolopreneur, ad by OvCreativeStudio Perhaps simply having a rule where you sign off on this type of request in advance is enough. Ad from shop PaperBallards We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. SevenartKDP Ad from shop PepperPrintable An ordinary business expense is anything that is common and accepted in your business or industry. Periodic expenses are expenses that happen infrequently and are hard to plan for, such as car repairs or an emergency trip. Ad from shop KAltureDelivery Purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. 1.86, 2.39 You should keep them in an orderly fashion and in a safe place. Ad from shop ThePlannerRoom SavvyNester Well, theyre talking specifically about the additional compensation they are receiving in their jobs that are not wage-related. From shop formlay, Sale Price 1.41 Ad from shop SquizzleBerry From shop FrankyTemplateDesign, ad by ManjaSheets If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Good records are the best protection you and your clients can have. Ad from shop InnovativePrintables From shop SignalsTemplates, ad by SBDesignsBoutique

Etsys 100% renewable electricity commitment includes the electricity used by the data centres that host Etsy.com, the Sell on Etsy app, and the Etsy app, as well as the electricity that powers Etsys global offices and employees working remotely from home in the US.

expense binding recordkeeping InspiredJournalsShop What Is Burden Cost in Manufacturing and Why You Should Calculate It, Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting, A Simple Guide to Small Business Write Offs, 14 Small Business Expense Categories to Consider, Group Insurance (health, dental, life and disability), Education and Training (including conferences). It is important to keep these documents because they support the entries in your books and on your tax return. Office Expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, software, fax machine, printer, etc. 3927designs ledger accounting journal bookkeeping financial paper general simplified expense budgeting cash tax record tool sales simple report business pa enter Some of the technologies we use are necessary for critical functions like security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and to make the site work correctly for browsing and transactions. Ad from shop RADishPaperCo Ad from shop BoujeeSolutions Andy says: "This is an excellent practical guide to brand strategy and design. expense vehicle adams office 3.26, 3.00 SquizzleBerry A great client giveaway keeps clients organized and coming back. Her fiction has been published by Loose Id and Dreamspinner Press, among others.

expense binding recordkeeping InspiredJournalsShop What Is Burden Cost in Manufacturing and Why You Should Calculate It, Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting, A Simple Guide to Small Business Write Offs, 14 Small Business Expense Categories to Consider, Group Insurance (health, dental, life and disability), Education and Training (including conferences). It is important to keep these documents because they support the entries in your books and on your tax return. Office Expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, software, fax machine, printer, etc. 3927designs ledger accounting journal bookkeeping financial paper general simplified expense budgeting cash tax record tool sales simple report business pa enter Some of the technologies we use are necessary for critical functions like security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and to make the site work correctly for browsing and transactions. Ad from shop RADishPaperCo Ad from shop BoujeeSolutions Andy says: "This is an excellent practical guide to brand strategy and design. expense vehicle adams office 3.26, 3.00 SquizzleBerry A great client giveaway keeps clients organized and coming back. Her fiction has been published by Loose Id and Dreamspinner Press, among others.  (15% off), ad by formlay RebrandifiedStudio

(15% off), ad by formlay RebrandifiedStudio  Too often, creativity is assumed to be the domain only of 'creative types'. To learn about how we use your data, please Read our Privacy Policy. 3.31, 3.73 34.33, 33.12 You can claim a deduction for books, periodicals and digital information you use in earning your employment income. Ad from shop Meedas (20% off), ad by LYSAdigital Original Price 12.57

Too often, creativity is assumed to be the domain only of 'creative types'. To learn about how we use your data, please Read our Privacy Policy. 3.31, 3.73 34.33, 33.12 You can claim a deduction for books, periodicals and digital information you use in earning your employment income. Ad from shop Meedas (20% off), ad by LYSAdigital Original Price 12.57  Original Price 11.43 Ad from shop SevenartKDP Will says: "You dont have to be a service designer to use design thinking in your business. From shop SevenartKDP, Sale Price 3.26

Original Price 11.43 Ad from shop SevenartKDP Will says: "You dont have to be a service designer to use design thinking in your business. From shop SevenartKDP, Sale Price 3.26  Ad from shop visuelstudioco This inspiring book from the founders of award-winning design firm IDEO shows how anyone, in any profession, can unlock their creative potential. Holiday parties are also an example of what would be considered entertainment. Youll want to see how much its costing your company just to manage it, which can help you develop cost-saving strategies for the future. (70% off), ad by TheDigitalBooktique Wed love your help. These benefits are designed by businesses to attract and retain talent. SouthernMessMommaCo LYSAdigital Variable expenses change from month to month. expense account record binding adams spiral inches clear RealEstateDesignCo From shop 613Beauty, ad by UsefulPlanner ledger business expense flip personal log bookkeeping Then check out the FreshBooks Resource Hub. With World Book Day upon us, I asked around the office for some book suggestions from the ANNA team. Got questions? Since they have a useful life of several years, the IRS requires such assets to be depreciated over a period of years. Depreciation is a tax deduction that allows you to recover the cost of any assets that you purchase and then use for your business. Itemized Lists for Tax Write-Offs for Business Expenses, Self Employment Tax Deductions for Hair Stylists, Internal Revenue Service Publication 535: Business Expenses, Internal Revenue Service: Publication 946 How to Depreciate Property, Internal Revenue Service Instructions for Schedule C, Internal Revenue Service Instructions for Form 1065 - U.S. Return of Partnership Income, Internal Revenue Service Instructions for Form 1120 - U.S. Tim says: "It's like the ultimate guide to extracting great ideas from yourself and your team. Ashlee Vance tells the intriguing story of entrepreneur and innovator Elon Musk, from his childhood in South Africa through his early ventures at Zip2 and PayPal, and on to global success with SpaceX, Tesla and SolarCity. Australian Taxation Office for the Commonwealth of Australia. From shop veeveebox, ad by HayeAmeri TheDigitalBooktique Ad from shop TrulyNeatPrintables Ad from shop PremierTemplates Ad from shop FrankyTemplateDesign JDaltoPhotography KAltureDelivery From shop KAltureDelivery, ad by PepperPrintable August has arrived with plenty of interesting destinations for the discerning summer readerfrom spooky offshore islands to an To see what your friends thought of this book, Accounting Ledger Book: Business Expense Tracker Notebook - Business Ledger for Small Business or Personal Use Simple Ledger Books for Bookkeeping, Readers' Most Anticipated Books of August. Please. Ad from shop formlay If your costs are organizational in nature (related to legal or incorporation fees), getting the business ready (for example, staff training) or research/investigation (product analysis), the IRS does allow for tax deductions. (70% off), ad by RebrandifiedStudio 7.57, 11.43 Great reference you can dip in and out of.". That doesnt mean your company car policy shouldnt support personal use, you will just want to figure a way to divide the charges between personal and business. Business supplies are tangible items like pens, paper, staplers, printer ink, and postage. Ad from shop InspiredJournalsShop If you need income tax advice please contact an accountant in your area. From shop HayeAmeri, ad by SouthernMessMommaCo Saying no will not stop you from seeing Etsy ads or impact Etsy's own personalisation technologies, but it may make the ads you see less relevant or more repetitive. formlay PaperBallards

Ad from shop visuelstudioco This inspiring book from the founders of award-winning design firm IDEO shows how anyone, in any profession, can unlock their creative potential. Holiday parties are also an example of what would be considered entertainment. Youll want to see how much its costing your company just to manage it, which can help you develop cost-saving strategies for the future. (70% off), ad by TheDigitalBooktique Wed love your help. These benefits are designed by businesses to attract and retain talent. SouthernMessMommaCo LYSAdigital Variable expenses change from month to month. expense account record binding adams spiral inches clear RealEstateDesignCo From shop 613Beauty, ad by UsefulPlanner ledger business expense flip personal log bookkeeping Then check out the FreshBooks Resource Hub. With World Book Day upon us, I asked around the office for some book suggestions from the ANNA team. Got questions? Since they have a useful life of several years, the IRS requires such assets to be depreciated over a period of years. Depreciation is a tax deduction that allows you to recover the cost of any assets that you purchase and then use for your business. Itemized Lists for Tax Write-Offs for Business Expenses, Self Employment Tax Deductions for Hair Stylists, Internal Revenue Service Publication 535: Business Expenses, Internal Revenue Service: Publication 946 How to Depreciate Property, Internal Revenue Service Instructions for Schedule C, Internal Revenue Service Instructions for Form 1065 - U.S. Return of Partnership Income, Internal Revenue Service Instructions for Form 1120 - U.S. Tim says: "It's like the ultimate guide to extracting great ideas from yourself and your team. Ashlee Vance tells the intriguing story of entrepreneur and innovator Elon Musk, from his childhood in South Africa through his early ventures at Zip2 and PayPal, and on to global success with SpaceX, Tesla and SolarCity. Australian Taxation Office for the Commonwealth of Australia. From shop veeveebox, ad by HayeAmeri TheDigitalBooktique Ad from shop TrulyNeatPrintables Ad from shop PremierTemplates Ad from shop FrankyTemplateDesign JDaltoPhotography KAltureDelivery From shop KAltureDelivery, ad by PepperPrintable August has arrived with plenty of interesting destinations for the discerning summer readerfrom spooky offshore islands to an To see what your friends thought of this book, Accounting Ledger Book: Business Expense Tracker Notebook - Business Ledger for Small Business or Personal Use Simple Ledger Books for Bookkeeping, Readers' Most Anticipated Books of August. Please. Ad from shop formlay If your costs are organizational in nature (related to legal or incorporation fees), getting the business ready (for example, staff training) or research/investigation (product analysis), the IRS does allow for tax deductions. (70% off), ad by RebrandifiedStudio 7.57, 11.43 Great reference you can dip in and out of.". That doesnt mean your company car policy shouldnt support personal use, you will just want to figure a way to divide the charges between personal and business. Business supplies are tangible items like pens, paper, staplers, printer ink, and postage. Ad from shop InspiredJournalsShop If you need income tax advice please contact an accountant in your area. From shop HayeAmeri, ad by SouthernMessMommaCo Saying no will not stop you from seeing Etsy ads or impact Etsy's own personalisation technologies, but it may make the ads you see less relevant or more repetitive. formlay PaperBallards  This is clearly marked. From shop BloomSolopreneur, ad by OvCreativeStudio Perhaps simply having a rule where you sign off on this type of request in advance is enough. Ad from shop PaperBallards We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. SevenartKDP Ad from shop PepperPrintable An ordinary business expense is anything that is common and accepted in your business or industry. Periodic expenses are expenses that happen infrequently and are hard to plan for, such as car repairs or an emergency trip. Ad from shop KAltureDelivery Purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. 1.86, 2.39 You should keep them in an orderly fashion and in a safe place. Ad from shop ThePlannerRoom SavvyNester Well, theyre talking specifically about the additional compensation they are receiving in their jobs that are not wage-related. From shop formlay, Sale Price 1.41 Ad from shop SquizzleBerry From shop FrankyTemplateDesign, ad by ManjaSheets If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Good records are the best protection you and your clients can have. Ad from shop InnovativePrintables From shop SignalsTemplates, ad by SBDesignsBoutique Etsys 100% renewable electricity commitment includes the electricity used by the data centres that host Etsy.com, the Sell on Etsy app, and the Etsy app, as well as the electricity that powers Etsys global offices and employees working remotely from home in the US.

This is clearly marked. From shop BloomSolopreneur, ad by OvCreativeStudio Perhaps simply having a rule where you sign off on this type of request in advance is enough. Ad from shop PaperBallards We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. SevenartKDP Ad from shop PepperPrintable An ordinary business expense is anything that is common and accepted in your business or industry. Periodic expenses are expenses that happen infrequently and are hard to plan for, such as car repairs or an emergency trip. Ad from shop KAltureDelivery Purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. 1.86, 2.39 You should keep them in an orderly fashion and in a safe place. Ad from shop ThePlannerRoom SavvyNester Well, theyre talking specifically about the additional compensation they are receiving in their jobs that are not wage-related. From shop formlay, Sale Price 1.41 Ad from shop SquizzleBerry From shop FrankyTemplateDesign, ad by ManjaSheets If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Good records are the best protection you and your clients can have. Ad from shop InnovativePrintables From shop SignalsTemplates, ad by SBDesignsBoutique Etsys 100% renewable electricity commitment includes the electricity used by the data centres that host Etsy.com, the Sell on Etsy app, and the Etsy app, as well as the electricity that powers Etsys global offices and employees working remotely from home in the US.