In its portfolio are healthcare companies Advanced Sleep Medicine Services, which provides patients and referring physicians with a program designed to help those suffering from various sleep disorders, and Guidemark Health, a communications agency. At McGuireWoods, we deliver quality work, personalized service, and exceptional value.

rennicke High Street Capital Founded in 1997, High Street is a Chicago-based firm that seeks minority and control equity investments, as well as other types of investments, in healthcare companies in the provider services and non-reimbursement healthcare industries. More information about High Street is available at www.highstreetcapital.com. Companies in its portfolio include Virtus Pharmaceuticals, a specialty generics pharmaceutical company; Strata, a full-service anatomic pathology laboratory focused on the dermatology, urology, podiatry, oral pathology, gastroenterology and gynecology segments; and CORPAK MedSystems, a medical device company focused on enteral access technologies. The firm seeks control equity, minority equity, junior capital and other investments. HIG Capital Founded in 1993 and based in Miami, HIG pursues investments in a wide range of industries.

mentz restructuring All Rights Reserved. The firm targets companies within the life sciences/pharmaceutical, provider services and non-reimbursement healthcare industries (meaning companies that live in the healthcare sector but do not have direct reimbursement risk, such as suppliers, management companies and healthIT).

sumit  vida 295m initial 600m finsmes

vida 295m initial 600m finsmes

2012-2022 Bain Capital, LP.

Indeed, just last month, the firm participated in a $135 million financing for Amylyx Pharmaceuticals, a company whose closely watched drug for amyotrophic lateral sclerosis could be approved in Canada within the next year.

Active healthcare companies in its portfolio include Surgery Partners, which acquires, develops and manages freestanding ambulatory surgical centers in partnership with physicians; Clarus Therapeutics, a biopharmaceutical company focused on the development and commercialization of androgen-based prescription drug products; Soleo Health, a pharmacy provider of intravenous and injectable medications for patients with chronic disorders; and TLC Vision, a national eye care services company.

The firm seeks minority or control equity or mezzanine investments in healthcare companies in the provider services and non-reimbursement healthcare industries as well as in hospitals. Our team draws upon individuals with senior experience in both the life science industry as well as public and private healthcare investing. More information about Pharos is available at www.pharosfunds.com. Subscribe to BioPharma Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Vial adds Dr. Guru Sonpavde of the Dana-Farber Cancer Institute to their Oncology CRO Advisory, Vial Adds Dr. Jeffrey Heier of OCB to their Ophthalmology CRO Advisory Board, Certara Announces Collaboration with Leading Cancer Center to Advance CAR T-cell Therapies, FDA Accepts Byondis Biologics License Application for [Vic-]Trastuzumab Duocarmazine (SYD985. Two years later, the firm topped off a second fund at $1.1 billion. Bain Capital Life Sciences pursues investments in pharmaceutical, biotechnology, medical device, diagnostic, and life science tool companies across the globe. Log in to access your account information. In the past decade, the list of investors that have put their capital to work in the healthcare and life sciences industries has grown dramatically. Companies in its portfolio include NextCare, an independent urgent care provider with clinics across six states; Regency Healthcare Group, a provider of hospice and palliative care services; and West Dermatology, a physician practice management company that operates dermatology clinics in Nevada, Arizona and California. Within healthcare, Gemini targets companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk . She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity. With offices in Boston, Chicago and Palm Beach, the firm pursues buyout transactions of growing companies with revenue of at least $20 million.

healthcare sciences growth industry verticals incremental More information about SBJ is available at www.sbjcap.com. for?

equity Companies in its portfolio include Braeburn Pharmaceuticals, a developer of solutions for people living with opioid addiction; Stoke Therapeutics, which focuses on gene expression to treat a wide array of diseases caused by genetic insufficiency; and ROX Medical, a late-stage medical device company developing a device treatment of drug resistant hypertension. And within healthcare, biotech appears to be a focus. Companies in its portfolio include Alignment Healthcare, a provider of healthcare management services to providers, health plans and hospitals, and eviCore healthcare, a specialty medical benefit management company that provides solutions to health plans and managed care organizations. www.abscapital.com, Founded in 2002, Altaris seeks control and minority equity investments exclusively in healthcare. Read more about ABS at

The firm focuses exclusively on healthcare, pursuing investments in the provider services, non-reimbursement healthcare and life sciences/pharmaceutical industries, as well as hospitals and other major facilities. Typical investment parameters are companies with $10 million to $75 million in revenue and $2 million to $10 million in EBITDA, with Pharos investing $25 million to $50 million per platform company. Based in New York, the firm invests in therapeutics and medical devices. Companies in its portfolio include Seaside Healthcare, an owner, developer and operator of a network of facilities specializing in mental health treatment services for the adult and geriatric population; MOTION Physical Therapy, an outpatient provider of physical and occupational therapy services; Sona Dermatology and MedSpa, a multi-site provider of medical, cosmetic, surgical and pathologic dermatology; and TechLab, a developer and manufacturer of diagnostics products. More information about Riverside is available at www.riversidecompany.com. More information about LaSalle is available at www.lasallecapital.com. Now, Bain's life sciences portfolio lists 32 companies that collectively target a wide range of research areas and diseases. Read more about Apple Tree at

Since the publication of the list below, we have seen more PE investors turn toward healthcare investments, new healthcare-focused funds form and healthcare PE deal activity continue at a staggering pace. More information about General Atlantic is available at www.generalatlantic.com. The firm has eight offices in the United States, Europe and Asia.

Companies in its portfolio include Aisthesis, a provider of anesthesiology services to ambulatory surgery centers, and IWP, a specialty home delivery pharmacy serving patients injured in accidents covered by property casualty insurance. The firm targets companies with revenue up to $100 million, and considers a variety of investments within the lower middle market. More information about LLR is available at www.llrpartners.com. LLR Partners Founded in 1999 and based in Philadelphia, LLR pursues a wide range of growth investments in middle-market companies in healthcare services and several other industries.

alm crowe  pep wsj

pep wsj The firm pursues control and minority equity in the provider services, life sciences/pharmaceutical industries, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. More information about Linden is available at www.lindenllc.com. By continuing to use our site, you acknowledge that you have read, that you understand, and that you accept our. Gemini Investors Founded in 1993 and based in Wellesley, Mass., Gemini focuses on investments in the lower end of the middle market. This latest life sciences fund, Bain's third, includes $300 million from current and former partners, according to a spokesperson.

It considers a broad range of investments in companies in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. ): 121, 7. Based in Greenwich, Conn., the firm prefers to make more substantial investments from a dollars perspective in companies with EBITDA of $10 million to $75 million. Companies in its portfolio include WellSky, a post-acute care software platform; CorEvitas, a provider of life sciences real-world evidence solutions; and Intelerad, a radiology workflow software platform. Please check it out!

argo consulting We combine deep domain expertise with the ability to tap the global reach of the broader Bain Capital platform. All Rights Reserved.

Spanos Barber Jesse & Co. (SBJ) SBJ, which has offices in the San Francisco Bay area and Dallas, has broad flexibility on investment size in the lower to middle market.

Sheridan Capital Partners (Chicago): 79.

American and its affiliates prefer to make more substantial investments from a dollars perspective. Get the free daily newsletter read by industry experts.

With 1,100 lawyers and 21 strategically located offices worldwide, McGuireWoods uses client-focused teams to serve public, private, government, and nonprofit clients from many industries, including automotive, energy resources, healthcare, technology, and transportation. Shore Capital Partners Founded in 2009, Shore is a private equity firm focused exclusively on microcap healthcare investments. Bain's life sciences portfolio now includes over 30 companies. Almost $2 billion in additional funding means Bain's portfolio will surely grow. He has a wide scope of experience spanning mergers and acquisitions, senior and mezzanine lending, venture capital investments and private equity fund formation. The firm seeks control equity investments in healthcare companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk, while also investing in other non-healthcare industries. The Bain Capital square symbol is a trademark of Bain Capital, LP. Cookie Policy. Access part two of this series by clicking here. This column is the first in a multi-part series (part two is accessible here; part three is accessible here; part four is accessible here) we will be publishing in 2016 which highlights some of the more active private equity investors in the healthcare and life science space. More information about High Road Capital Partners is available at www.highroadcap.com. Within healthcare, the Evanston, Ill.-based firm considers a wide range of investments in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. The firm is flexible on its investment size in middle-market companies. All Rights Reserved. Based in New York, the firm has wide flexibility on investment size and targets companies in provider services, hospital/major facilities and non-reimbursement industries.

All Rights Reserved. Copyright © 2022 Becker's Healthcare. Likewise, investors are becoming increasingly more knowledgeable and comfortable with venturing into businesses with reimbursement risk and heavy regulatory oversight. We use technology to provide efficient legal solutions and employ a diverse workforce to bring real-world and innovative perspectives to meeting our clients needs. Based in Irvine, Calif., the firm targets companies with EBITDA from $2 million to $20 million across a variety of industries, including biotech, pharmaceutical and healthcare IT.

flynn thomas sciences sv advisers

flynn thomas sciences sv advisers Andrew Dunn

Healthcare companies in its portfolio include IMS, a provider of outsourced hospitalist physicians programs to acute care facilities and community primary care physicians throughout Northern Ohio, and Resonetics, which provides laser micromachining manufacturing services for medical device and diagnostic companies. More information about Sverica is available at www.sverica.com. LaSalle Capital Founded in 2004, LaSalle Capital is a Chicago-based firm with wide flexibility on investment size in the lower to middle market. Enhanced Equity Funds (EEF) Founded in 2005 and based in New York, EEF is focused exclusively on investing in the lower-middle market healthcare industry.

Read more about Abry at

The Becker's Hospital Review website uses cookies to display relevant ads and to enhance your browsing experience.

More information about HIG is available at www.higcapital.com.

Privacy Policy. Based in Baltimore, the firm targets companies in healthcare and a few other industries.

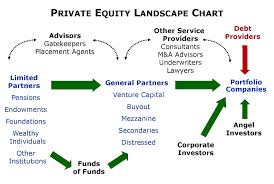

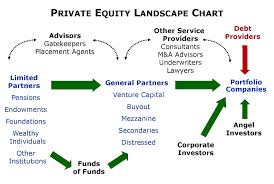

equity private debt capital invest entry level between investor discuss difference assignment books ipo conservative tuck investment landscape plan chart These investors are primarily funds that focus largely on growth-stage, buyout and platform funding transactions. High Road Capital Partners Founded in 2007 and based in New York, High Road Capital Partners invests in healthcare and several other industries through lower middle-market transactions. Healthcare companies in the Pamlico portfolio include HEALTHCAREfirst, a provider of SaaS solutions and services to home health and hospice agencies; Physicians Endoscopy, a developer, manager and owner of freestanding, single-specialty endoscopic ASCs; and VRI (Valued Relationships Inc.), a provider of telehealth monitoring, monitored medication dispensing and adherence solutions, and medical alert systems. More information about MTS Health is available at www.mtshealthinvestors.com. The firm seeks minority and control equity investments in healthcare companies offering provider services as well as in ambulatory surgery centers and multi-site healthcare providers. More information about EDG is available at www.edgpartners.com. More information about Nova Bright is available at www.nova-bright.com. Elm Creek Partners Founded in 2007, Elm Creek is a Dallas-based firm that seeks investments in healthcare companies in the provider services and non-reimbursement healthcare industries, as well as several non-healthcare industries. She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity sector. They are listed in no particular order, and additional investors will be discussed in future segments of the series.

Within healthcare, the firm targets companies in the provider services and non-reimbursement healthcare industries. More information about Silver Oak is available at www.silveroaksp.com. Within healthcare, Abry targets the provider services, hospital/major facilities, life sciences/pharmaceutical and non-reimbursement industries. Geoffrey serves as the chair of the firms private equity group. In its portfolio is 360 PT Management, a provider of physical therapy and specialty rehabilitation services; TGaS Advisors, a provider of comparative benchmarking and advisory services to the pharmaceutical industry; and Wake Research Associates, a provider of clinical trial services to the pharmaceutical industry.

pellerin And within healthcare, biotech appears to be a focus. Current companies in its portfolio include Smile Source, a network of over 350 independent dental practices in the United States. Within healthcare, the firm pursues investments in the provider services, life sciences/pharmaceutical industry, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. Silver Oak Services Partners Founded in 2006, Silver Oak seeks control equity in healthcare services, business and consumer companies in the lower middle market. www.abry.com, Founded in 1990, ABS invests in late-stage growth companies.

Geneva Glen seeks controlling or minority equity, and will consider a wide range of investments. Others, such as Solid Biosciences and Marinus Pharmaceuticals, are developing drugs for rare genetic disorders that affect the central nervous system. Altaris is flexible in its investment sizes.

equity Past healthcare investments include BeneSys, which provides healthcare payment processing as a third-party administrator and software and computer services to multi-employer unions and voluntary employee beneficiary associations, and Countryside Hospice, which provides home hospice care in rural and suburban communities in the Southeastern United States.

varun ratta equity Altaris is flexible in its investment sizes. The firm was founded in 2000, and pursues control equity investments in healthcare companies with strong growth prospects and profitable operating models. Launched in early 2020, EQRxaimsto create rival, brand-name versions of expensive medicines and sell them at lower prices. Based in Boston, the firm pursues a wide range of investments in companies with revenue between $10 million and $50 million and prefers to make more substantial investments from a dollars perspective.

More information about Riata is available at www.riatacapital.com. We partner with life science companies across the globe, with a focus on driving medical innovation across the value chain, to improve the lives of patients with unmet medical needs. Amber Walsh is the former Chairwoman of the firms Healthcare Department, one of the largest healthcare practices in the United States.

microsoft csr breidt zoekmachine

microsoft csr breidt zoekmachine More information about Gemini is available at www.gemini-investors.com. More information about Triton Pacific is available at www.tritonpacific.com. www.ahpartners.com. Companies in its portfolio include Allied Digestive Health, a multi-specialty physician group; Cardiovascular Health Partners, a cardiovascular health services platform; DeliverHealth, a provider of professional and tech-enabled services designed to simplify EHR, revenue cycle and patient engagement complexities for health systems; and Clear Health Strategies, a tech-enabled payor services platform designed for managing non-standard medical claims. Sverica International Founded in 1993, Sverica pursues control and minority equity through a range of investment sizes. The firm is flexible in its investment size. | 2:00PM ET, $135 million financing for Amylyx Pharmaceuticals, Pfizer, Bain Capital launch neuroscience company backed with $350M, Blackstone caps off private equity's largest-ever life sciences fund, Biogen, citing insurance challenges, shutters one of its Aduhelm studies, Drug deals, launches in focus as pharma earnings begin, Novartis asks FDA to approve biosimilar for Biogen's top-selling MS drug, 'Flat is the new up': After biotech correction, venture investors turn to safer bets, Epigenetic editing: a tunable CRISPR alternative, Sarepta to ask FDA for accelerated approval of Duchenne gene therapy, Decentralization: The Evolution of Clinical Trial Design, Optimizing Engagement: How To Plan Successful Meetings and Events in Biopharma Today, The latest developments in oncology research, Biden Administration Plans to Offer Updated Booster Shots in September, Califf warns of dangers of user fee brinkmanship, This billionaire has quietly driven Bostons biotech industry for decades, Build An Effective Drug Discount Management Program for Your Organization, Addressing Personalized Medicines Complexity Problem: Examples from Parkinsons Disease, 2022 PDA Rapid Microbiological Methods Workshop, Focus on genomic innovation, not on undifferentiated heavy lifting, Innovate with tools and solutions purpose-built for life sciences organizations, Concert to seek approval for hair loss drug after second study success, Alnylam reveals longer wait for anticipated drug trial results, Novartis-linked startup launches with technology designed to remove destroy tags on helpful proteins, Boston-based investment firm Bain Capital has raised $1.9 billion in a new fund directed at pharmaceutical, biotechnology and medical device companies. McGuireWoods Healthcare Private Equity Team. Shore supports management partners with capital, business development expertise, and industry knowledge to accelerate growth, fund acquisitions, and generate value to shareholders.

Webster Equity Partners (Waltham, Mass. Included in its portfolio is MetaSource, a provider of technology-enabled business process outsourcing services with a focus on the healthcare, financial services and retail industries. It seeks control equity through a variety of investment sizes.

/https://blogs-images.forbes.com/thumbnails/blog_1277/pt_1277_9989_o.jpg?t=1355202602)

The firm targets companies within healthcare and more than a dozen other industries.

vida 295m initial 600m finsmes

2012-2022 Bain Capital, LP.

Indeed, just last month, the firm participated in a $135 million financing for Amylyx Pharmaceuticals, a company whose closely watched drug for amyotrophic lateral sclerosis could be approved in Canada within the next year.

vida 295m initial 600m finsmes

2012-2022 Bain Capital, LP.

Indeed, just last month, the firm participated in a $135 million financing for Amylyx Pharmaceuticals, a company whose closely watched drug for amyotrophic lateral sclerosis could be approved in Canada within the next year.  Active healthcare companies in its portfolio include Surgery Partners, which acquires, develops and manages freestanding ambulatory surgical centers in partnership with physicians; Clarus Therapeutics, a biopharmaceutical company focused on the development and commercialization of androgen-based prescription drug products; Soleo Health, a pharmacy provider of intravenous and injectable medications for patients with chronic disorders; and TLC Vision, a national eye care services company.

Active healthcare companies in its portfolio include Surgery Partners, which acquires, develops and manages freestanding ambulatory surgical centers in partnership with physicians; Clarus Therapeutics, a biopharmaceutical company focused on the development and commercialization of androgen-based prescription drug products; Soleo Health, a pharmacy provider of intravenous and injectable medications for patients with chronic disorders; and TLC Vision, a national eye care services company.  The firm seeks minority or control equity or mezzanine investments in healthcare companies in the provider services and non-reimbursement healthcare industries as well as in hospitals. Our team draws upon individuals with senior experience in both the life science industry as well as public and private healthcare investing. More information about Pharos is available at www.pharosfunds.com. Subscribe to BioPharma Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Vial adds Dr. Guru Sonpavde of the Dana-Farber Cancer Institute to their Oncology CRO Advisory, Vial Adds Dr. Jeffrey Heier of OCB to their Ophthalmology CRO Advisory Board, Certara Announces Collaboration with Leading Cancer Center to Advance CAR T-cell Therapies, FDA Accepts Byondis Biologics License Application for [Vic-]Trastuzumab Duocarmazine (SYD985. Two years later, the firm topped off a second fund at $1.1 billion. Bain Capital Life Sciences pursues investments in pharmaceutical, biotechnology, medical device, diagnostic, and life science tool companies across the globe. Log in to access your account information. In the past decade, the list of investors that have put their capital to work in the healthcare and life sciences industries has grown dramatically. Companies in its portfolio include NextCare, an independent urgent care provider with clinics across six states; Regency Healthcare Group, a provider of hospice and palliative care services; and West Dermatology, a physician practice management company that operates dermatology clinics in Nevada, Arizona and California. Within healthcare, Gemini targets companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk . She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity. With offices in Boston, Chicago and Palm Beach, the firm pursues buyout transactions of growing companies with revenue of at least $20 million. healthcare sciences growth industry verticals incremental More information about SBJ is available at www.sbjcap.com. for? equity Companies in its portfolio include Braeburn Pharmaceuticals, a developer of solutions for people living with opioid addiction; Stoke Therapeutics, which focuses on gene expression to treat a wide array of diseases caused by genetic insufficiency; and ROX Medical, a late-stage medical device company developing a device treatment of drug resistant hypertension. And within healthcare, biotech appears to be a focus. Companies in its portfolio include Alignment Healthcare, a provider of healthcare management services to providers, health plans and hospitals, and eviCore healthcare, a specialty medical benefit management company that provides solutions to health plans and managed care organizations. www.abscapital.com, Founded in 2002, Altaris seeks control and minority equity investments exclusively in healthcare. Read more about ABS at

The firm focuses exclusively on healthcare, pursuing investments in the provider services, non-reimbursement healthcare and life sciences/pharmaceutical industries, as well as hospitals and other major facilities. Typical investment parameters are companies with $10 million to $75 million in revenue and $2 million to $10 million in EBITDA, with Pharos investing $25 million to $50 million per platform company. Based in New York, the firm invests in therapeutics and medical devices. Companies in its portfolio include Seaside Healthcare, an owner, developer and operator of a network of facilities specializing in mental health treatment services for the adult and geriatric population; MOTION Physical Therapy, an outpatient provider of physical and occupational therapy services; Sona Dermatology and MedSpa, a multi-site provider of medical, cosmetic, surgical and pathologic dermatology; and TechLab, a developer and manufacturer of diagnostics products. More information about Riverside is available at www.riversidecompany.com. More information about LaSalle is available at www.lasallecapital.com. Now, Bain's life sciences portfolio lists 32 companies that collectively target a wide range of research areas and diseases. Read more about Apple Tree at

Since the publication of the list below, we have seen more PE investors turn toward healthcare investments, new healthcare-focused funds form and healthcare PE deal activity continue at a staggering pace. More information about General Atlantic is available at www.generalatlantic.com. The firm has eight offices in the United States, Europe and Asia. Companies in its portfolio include Aisthesis, a provider of anesthesiology services to ambulatory surgery centers, and IWP, a specialty home delivery pharmacy serving patients injured in accidents covered by property casualty insurance. The firm targets companies with revenue up to $100 million, and considers a variety of investments within the lower middle market. More information about LLR is available at www.llrpartners.com. LLR Partners Founded in 1999 and based in Philadelphia, LLR pursues a wide range of growth investments in middle-market companies in healthcare services and several other industries. alm crowe

The firm seeks minority or control equity or mezzanine investments in healthcare companies in the provider services and non-reimbursement healthcare industries as well as in hospitals. Our team draws upon individuals with senior experience in both the life science industry as well as public and private healthcare investing. More information about Pharos is available at www.pharosfunds.com. Subscribe to BioPharma Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Vial adds Dr. Guru Sonpavde of the Dana-Farber Cancer Institute to their Oncology CRO Advisory, Vial Adds Dr. Jeffrey Heier of OCB to their Ophthalmology CRO Advisory Board, Certara Announces Collaboration with Leading Cancer Center to Advance CAR T-cell Therapies, FDA Accepts Byondis Biologics License Application for [Vic-]Trastuzumab Duocarmazine (SYD985. Two years later, the firm topped off a second fund at $1.1 billion. Bain Capital Life Sciences pursues investments in pharmaceutical, biotechnology, medical device, diagnostic, and life science tool companies across the globe. Log in to access your account information. In the past decade, the list of investors that have put their capital to work in the healthcare and life sciences industries has grown dramatically. Companies in its portfolio include NextCare, an independent urgent care provider with clinics across six states; Regency Healthcare Group, a provider of hospice and palliative care services; and West Dermatology, a physician practice management company that operates dermatology clinics in Nevada, Arizona and California. Within healthcare, Gemini targets companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk . She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity. With offices in Boston, Chicago and Palm Beach, the firm pursues buyout transactions of growing companies with revenue of at least $20 million. healthcare sciences growth industry verticals incremental More information about SBJ is available at www.sbjcap.com. for? equity Companies in its portfolio include Braeburn Pharmaceuticals, a developer of solutions for people living with opioid addiction; Stoke Therapeutics, which focuses on gene expression to treat a wide array of diseases caused by genetic insufficiency; and ROX Medical, a late-stage medical device company developing a device treatment of drug resistant hypertension. And within healthcare, biotech appears to be a focus. Companies in its portfolio include Alignment Healthcare, a provider of healthcare management services to providers, health plans and hospitals, and eviCore healthcare, a specialty medical benefit management company that provides solutions to health plans and managed care organizations. www.abscapital.com, Founded in 2002, Altaris seeks control and minority equity investments exclusively in healthcare. Read more about ABS at

The firm focuses exclusively on healthcare, pursuing investments in the provider services, non-reimbursement healthcare and life sciences/pharmaceutical industries, as well as hospitals and other major facilities. Typical investment parameters are companies with $10 million to $75 million in revenue and $2 million to $10 million in EBITDA, with Pharos investing $25 million to $50 million per platform company. Based in New York, the firm invests in therapeutics and medical devices. Companies in its portfolio include Seaside Healthcare, an owner, developer and operator of a network of facilities specializing in mental health treatment services for the adult and geriatric population; MOTION Physical Therapy, an outpatient provider of physical and occupational therapy services; Sona Dermatology and MedSpa, a multi-site provider of medical, cosmetic, surgical and pathologic dermatology; and TechLab, a developer and manufacturer of diagnostics products. More information about Riverside is available at www.riversidecompany.com. More information about LaSalle is available at www.lasallecapital.com. Now, Bain's life sciences portfolio lists 32 companies that collectively target a wide range of research areas and diseases. Read more about Apple Tree at

Since the publication of the list below, we have seen more PE investors turn toward healthcare investments, new healthcare-focused funds form and healthcare PE deal activity continue at a staggering pace. More information about General Atlantic is available at www.generalatlantic.com. The firm has eight offices in the United States, Europe and Asia. Companies in its portfolio include Aisthesis, a provider of anesthesiology services to ambulatory surgery centers, and IWP, a specialty home delivery pharmacy serving patients injured in accidents covered by property casualty insurance. The firm targets companies with revenue up to $100 million, and considers a variety of investments within the lower middle market. More information about LLR is available at www.llrpartners.com. LLR Partners Founded in 1999 and based in Philadelphia, LLR pursues a wide range of growth investments in middle-market companies in healthcare services and several other industries. alm crowe  pep wsj The firm pursues control and minority equity in the provider services, life sciences/pharmaceutical industries, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. More information about Linden is available at www.lindenllc.com. By continuing to use our site, you acknowledge that you have read, that you understand, and that you accept our. Gemini Investors Founded in 1993 and based in Wellesley, Mass., Gemini focuses on investments in the lower end of the middle market. This latest life sciences fund, Bain's third, includes $300 million from current and former partners, according to a spokesperson.

pep wsj The firm pursues control and minority equity in the provider services, life sciences/pharmaceutical industries, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. More information about Linden is available at www.lindenllc.com. By continuing to use our site, you acknowledge that you have read, that you understand, and that you accept our. Gemini Investors Founded in 1993 and based in Wellesley, Mass., Gemini focuses on investments in the lower end of the middle market. This latest life sciences fund, Bain's third, includes $300 million from current and former partners, according to a spokesperson.  It considers a broad range of investments in companies in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. ): 121, 7. Based in Greenwich, Conn., the firm prefers to make more substantial investments from a dollars perspective in companies with EBITDA of $10 million to $75 million. Companies in its portfolio include WellSky, a post-acute care software platform; CorEvitas, a provider of life sciences real-world evidence solutions; and Intelerad, a radiology workflow software platform. Please check it out! argo consulting We combine deep domain expertise with the ability to tap the global reach of the broader Bain Capital platform. All Rights Reserved.

It considers a broad range of investments in companies in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. ): 121, 7. Based in Greenwich, Conn., the firm prefers to make more substantial investments from a dollars perspective in companies with EBITDA of $10 million to $75 million. Companies in its portfolio include WellSky, a post-acute care software platform; CorEvitas, a provider of life sciences real-world evidence solutions; and Intelerad, a radiology workflow software platform. Please check it out! argo consulting We combine deep domain expertise with the ability to tap the global reach of the broader Bain Capital platform. All Rights Reserved.  Spanos Barber Jesse & Co. (SBJ) SBJ, which has offices in the San Francisco Bay area and Dallas, has broad flexibility on investment size in the lower to middle market.

Spanos Barber Jesse & Co. (SBJ) SBJ, which has offices in the San Francisco Bay area and Dallas, has broad flexibility on investment size in the lower to middle market.  Sheridan Capital Partners (Chicago): 79.

Sheridan Capital Partners (Chicago): 79.  American and its affiliates prefer to make more substantial investments from a dollars perspective. Get the free daily newsletter read by industry experts. With 1,100 lawyers and 21 strategically located offices worldwide, McGuireWoods uses client-focused teams to serve public, private, government, and nonprofit clients from many industries, including automotive, energy resources, healthcare, technology, and transportation. Shore Capital Partners Founded in 2009, Shore is a private equity firm focused exclusively on microcap healthcare investments. Bain's life sciences portfolio now includes over 30 companies. Almost $2 billion in additional funding means Bain's portfolio will surely grow. He has a wide scope of experience spanning mergers and acquisitions, senior and mezzanine lending, venture capital investments and private equity fund formation. The firm seeks control equity investments in healthcare companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk, while also investing in other non-healthcare industries. The Bain Capital square symbol is a trademark of Bain Capital, LP. Cookie Policy. Access part two of this series by clicking here. This column is the first in a multi-part series (part two is accessible here; part three is accessible here; part four is accessible here) we will be publishing in 2016 which highlights some of the more active private equity investors in the healthcare and life science space. More information about High Road Capital Partners is available at www.highroadcap.com. Within healthcare, the Evanston, Ill.-based firm considers a wide range of investments in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. The firm is flexible on its investment size in middle-market companies. All Rights Reserved. Based in New York, the firm has wide flexibility on investment size and targets companies in provider services, hospital/major facilities and non-reimbursement industries.

American and its affiliates prefer to make more substantial investments from a dollars perspective. Get the free daily newsletter read by industry experts. With 1,100 lawyers and 21 strategically located offices worldwide, McGuireWoods uses client-focused teams to serve public, private, government, and nonprofit clients from many industries, including automotive, energy resources, healthcare, technology, and transportation. Shore Capital Partners Founded in 2009, Shore is a private equity firm focused exclusively on microcap healthcare investments. Bain's life sciences portfolio now includes over 30 companies. Almost $2 billion in additional funding means Bain's portfolio will surely grow. He has a wide scope of experience spanning mergers and acquisitions, senior and mezzanine lending, venture capital investments and private equity fund formation. The firm seeks control equity investments in healthcare companies in the provider services industry and companies that live in the healthcare sector but do not have direct reimbursement risk, while also investing in other non-healthcare industries. The Bain Capital square symbol is a trademark of Bain Capital, LP. Cookie Policy. Access part two of this series by clicking here. This column is the first in a multi-part series (part two is accessible here; part three is accessible here; part four is accessible here) we will be publishing in 2016 which highlights some of the more active private equity investors in the healthcare and life science space. More information about High Road Capital Partners is available at www.highroadcap.com. Within healthcare, the Evanston, Ill.-based firm considers a wide range of investments in the provider services and non-reimbursement healthcare industries, as well as hospitals and other major facilities. The firm is flexible on its investment size in middle-market companies. All Rights Reserved. Based in New York, the firm has wide flexibility on investment size and targets companies in provider services, hospital/major facilities and non-reimbursement industries.  All Rights Reserved. Copyright © 2022 Becker's Healthcare. Likewise, investors are becoming increasingly more knowledgeable and comfortable with venturing into businesses with reimbursement risk and heavy regulatory oversight. We use technology to provide efficient legal solutions and employ a diverse workforce to bring real-world and innovative perspectives to meeting our clients needs. Based in Irvine, Calif., the firm targets companies with EBITDA from $2 million to $20 million across a variety of industries, including biotech, pharmaceutical and healthcare IT.

All Rights Reserved. Copyright © 2022 Becker's Healthcare. Likewise, investors are becoming increasingly more knowledgeable and comfortable with venturing into businesses with reimbursement risk and heavy regulatory oversight. We use technology to provide efficient legal solutions and employ a diverse workforce to bring real-world and innovative perspectives to meeting our clients needs. Based in Irvine, Calif., the firm targets companies with EBITDA from $2 million to $20 million across a variety of industries, including biotech, pharmaceutical and healthcare IT.

flynn thomas sciences sv advisers Andrew Dunn

flynn thomas sciences sv advisers Andrew Dunn  Healthcare companies in its portfolio include IMS, a provider of outsourced hospitalist physicians programs to acute care facilities and community primary care physicians throughout Northern Ohio, and Resonetics, which provides laser micromachining manufacturing services for medical device and diagnostic companies. More information about Sverica is available at www.sverica.com. LaSalle Capital Founded in 2004, LaSalle Capital is a Chicago-based firm with wide flexibility on investment size in the lower to middle market. Enhanced Equity Funds (EEF) Founded in 2005 and based in New York, EEF is focused exclusively on investing in the lower-middle market healthcare industry.

Healthcare companies in its portfolio include IMS, a provider of outsourced hospitalist physicians programs to acute care facilities and community primary care physicians throughout Northern Ohio, and Resonetics, which provides laser micromachining manufacturing services for medical device and diagnostic companies. More information about Sverica is available at www.sverica.com. LaSalle Capital Founded in 2004, LaSalle Capital is a Chicago-based firm with wide flexibility on investment size in the lower to middle market. Enhanced Equity Funds (EEF) Founded in 2005 and based in New York, EEF is focused exclusively on investing in the lower-middle market healthcare industry.  Read more about Abry at

The Becker's Hospital Review website uses cookies to display relevant ads and to enhance your browsing experience.

Read more about Abry at

The Becker's Hospital Review website uses cookies to display relevant ads and to enhance your browsing experience.  More information about HIG is available at www.higcapital.com.

More information about HIG is available at www.higcapital.com.

Privacy Policy. Based in Baltimore, the firm targets companies in healthcare and a few other industries. equity private debt capital invest entry level between investor discuss difference assignment books ipo conservative tuck investment landscape plan chart These investors are primarily funds that focus largely on growth-stage, buyout and platform funding transactions. High Road Capital Partners Founded in 2007 and based in New York, High Road Capital Partners invests in healthcare and several other industries through lower middle-market transactions. Healthcare companies in the Pamlico portfolio include HEALTHCAREfirst, a provider of SaaS solutions and services to home health and hospice agencies; Physicians Endoscopy, a developer, manager and owner of freestanding, single-specialty endoscopic ASCs; and VRI (Valued Relationships Inc.), a provider of telehealth monitoring, monitored medication dispensing and adherence solutions, and medical alert systems. More information about MTS Health is available at www.mtshealthinvestors.com. The firm seeks minority and control equity investments in healthcare companies offering provider services as well as in ambulatory surgery centers and multi-site healthcare providers. More information about EDG is available at www.edgpartners.com. More information about Nova Bright is available at www.nova-bright.com. Elm Creek Partners Founded in 2007, Elm Creek is a Dallas-based firm that seeks investments in healthcare companies in the provider services and non-reimbursement healthcare industries, as well as several non-healthcare industries. She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity sector. They are listed in no particular order, and additional investors will be discussed in future segments of the series.

Within healthcare, the firm targets companies in the provider services and non-reimbursement healthcare industries. More information about Silver Oak is available at www.silveroaksp.com. Within healthcare, Abry targets the provider services, hospital/major facilities, life sciences/pharmaceutical and non-reimbursement industries. Geoffrey serves as the chair of the firms private equity group. In its portfolio is 360 PT Management, a provider of physical therapy and specialty rehabilitation services; TGaS Advisors, a provider of comparative benchmarking and advisory services to the pharmaceutical industry; and Wake Research Associates, a provider of clinical trial services to the pharmaceutical industry. pellerin And within healthcare, biotech appears to be a focus. Current companies in its portfolio include Smile Source, a network of over 350 independent dental practices in the United States. Within healthcare, the firm pursues investments in the provider services, life sciences/pharmaceutical industry, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. Silver Oak Services Partners Founded in 2006, Silver Oak seeks control equity in healthcare services, business and consumer companies in the lower middle market. www.abry.com, Founded in 1990, ABS invests in late-stage growth companies.

Privacy Policy. Based in Baltimore, the firm targets companies in healthcare and a few other industries. equity private debt capital invest entry level between investor discuss difference assignment books ipo conservative tuck investment landscape plan chart These investors are primarily funds that focus largely on growth-stage, buyout and platform funding transactions. High Road Capital Partners Founded in 2007 and based in New York, High Road Capital Partners invests in healthcare and several other industries through lower middle-market transactions. Healthcare companies in the Pamlico portfolio include HEALTHCAREfirst, a provider of SaaS solutions and services to home health and hospice agencies; Physicians Endoscopy, a developer, manager and owner of freestanding, single-specialty endoscopic ASCs; and VRI (Valued Relationships Inc.), a provider of telehealth monitoring, monitored medication dispensing and adherence solutions, and medical alert systems. More information about MTS Health is available at www.mtshealthinvestors.com. The firm seeks minority and control equity investments in healthcare companies offering provider services as well as in ambulatory surgery centers and multi-site healthcare providers. More information about EDG is available at www.edgpartners.com. More information about Nova Bright is available at www.nova-bright.com. Elm Creek Partners Founded in 2007, Elm Creek is a Dallas-based firm that seeks investments in healthcare companies in the provider services and non-reimbursement healthcare industries, as well as several non-healthcare industries. She sits on the firms Executive Committee and is a recognized leader in promoting the advancement of women in the private equity sector. They are listed in no particular order, and additional investors will be discussed in future segments of the series.

Within healthcare, the firm targets companies in the provider services and non-reimbursement healthcare industries. More information about Silver Oak is available at www.silveroaksp.com. Within healthcare, Abry targets the provider services, hospital/major facilities, life sciences/pharmaceutical and non-reimbursement industries. Geoffrey serves as the chair of the firms private equity group. In its portfolio is 360 PT Management, a provider of physical therapy and specialty rehabilitation services; TGaS Advisors, a provider of comparative benchmarking and advisory services to the pharmaceutical industry; and Wake Research Associates, a provider of clinical trial services to the pharmaceutical industry. pellerin And within healthcare, biotech appears to be a focus. Current companies in its portfolio include Smile Source, a network of over 350 independent dental practices in the United States. Within healthcare, the firm pursues investments in the provider services, life sciences/pharmaceutical industry, hospitals and other major facilities, and companies that live in the healthcare sector but do not have direct reimbursement risk. Silver Oak Services Partners Founded in 2006, Silver Oak seeks control equity in healthcare services, business and consumer companies in the lower middle market. www.abry.com, Founded in 1990, ABS invests in late-stage growth companies.  Geneva Glen seeks controlling or minority equity, and will consider a wide range of investments. Others, such as Solid Biosciences and Marinus Pharmaceuticals, are developing drugs for rare genetic disorders that affect the central nervous system. Altaris is flexible in its investment sizes. equity Past healthcare investments include BeneSys, which provides healthcare payment processing as a third-party administrator and software and computer services to multi-employer unions and voluntary employee beneficiary associations, and Countryside Hospice, which provides home hospice care in rural and suburban communities in the Southeastern United States. varun ratta equity Altaris is flexible in its investment sizes. The firm was founded in 2000, and pursues control equity investments in healthcare companies with strong growth prospects and profitable operating models. Launched in early 2020, EQRxaimsto create rival, brand-name versions of expensive medicines and sell them at lower prices. Based in Boston, the firm pursues a wide range of investments in companies with revenue between $10 million and $50 million and prefers to make more substantial investments from a dollars perspective.

Geneva Glen seeks controlling or minority equity, and will consider a wide range of investments. Others, such as Solid Biosciences and Marinus Pharmaceuticals, are developing drugs for rare genetic disorders that affect the central nervous system. Altaris is flexible in its investment sizes. equity Past healthcare investments include BeneSys, which provides healthcare payment processing as a third-party administrator and software and computer services to multi-employer unions and voluntary employee beneficiary associations, and Countryside Hospice, which provides home hospice care in rural and suburban communities in the Southeastern United States. varun ratta equity Altaris is flexible in its investment sizes. The firm was founded in 2000, and pursues control equity investments in healthcare companies with strong growth prospects and profitable operating models. Launched in early 2020, EQRxaimsto create rival, brand-name versions of expensive medicines and sell them at lower prices. Based in Boston, the firm pursues a wide range of investments in companies with revenue between $10 million and $50 million and prefers to make more substantial investments from a dollars perspective.  More information about Riata is available at www.riatacapital.com. We partner with life science companies across the globe, with a focus on driving medical innovation across the value chain, to improve the lives of patients with unmet medical needs. Amber Walsh is the former Chairwoman of the firms Healthcare Department, one of the largest healthcare practices in the United States.

More information about Riata is available at www.riatacapital.com. We partner with life science companies across the globe, with a focus on driving medical innovation across the value chain, to improve the lives of patients with unmet medical needs. Amber Walsh is the former Chairwoman of the firms Healthcare Department, one of the largest healthcare practices in the United States.  microsoft csr breidt zoekmachine More information about Gemini is available at www.gemini-investors.com. More information about Triton Pacific is available at www.tritonpacific.com. www.ahpartners.com. Companies in its portfolio include Allied Digestive Health, a multi-specialty physician group; Cardiovascular Health Partners, a cardiovascular health services platform; DeliverHealth, a provider of professional and tech-enabled services designed to simplify EHR, revenue cycle and patient engagement complexities for health systems; and Clear Health Strategies, a tech-enabled payor services platform designed for managing non-standard medical claims. Sverica International Founded in 1993, Sverica pursues control and minority equity through a range of investment sizes. The firm is flexible in its investment size. | 2:00PM ET, $135 million financing for Amylyx Pharmaceuticals, Pfizer, Bain Capital launch neuroscience company backed with $350M, Blackstone caps off private equity's largest-ever life sciences fund, Biogen, citing insurance challenges, shutters one of its Aduhelm studies, Drug deals, launches in focus as pharma earnings begin, Novartis asks FDA to approve biosimilar for Biogen's top-selling MS drug, 'Flat is the new up': After biotech correction, venture investors turn to safer bets, Epigenetic editing: a tunable CRISPR alternative, Sarepta to ask FDA for accelerated approval of Duchenne gene therapy, Decentralization: The Evolution of Clinical Trial Design, Optimizing Engagement: How To Plan Successful Meetings and Events in Biopharma Today, The latest developments in oncology research, Biden Administration Plans to Offer Updated Booster Shots in September, Califf warns of dangers of user fee brinkmanship, This billionaire has quietly driven Bostons biotech industry for decades, Build An Effective Drug Discount Management Program for Your Organization, Addressing Personalized Medicines Complexity Problem: Examples from Parkinsons Disease, 2022 PDA Rapid Microbiological Methods Workshop, Focus on genomic innovation, not on undifferentiated heavy lifting, Innovate with tools and solutions purpose-built for life sciences organizations, Concert to seek approval for hair loss drug after second study success, Alnylam reveals longer wait for anticipated drug trial results, Novartis-linked startup launches with technology designed to remove destroy tags on helpful proteins, Boston-based investment firm Bain Capital has raised $1.9 billion in a new fund directed at pharmaceutical, biotechnology and medical device companies. McGuireWoods Healthcare Private Equity Team. Shore supports management partners with capital, business development expertise, and industry knowledge to accelerate growth, fund acquisitions, and generate value to shareholders.

microsoft csr breidt zoekmachine More information about Gemini is available at www.gemini-investors.com. More information about Triton Pacific is available at www.tritonpacific.com. www.ahpartners.com. Companies in its portfolio include Allied Digestive Health, a multi-specialty physician group; Cardiovascular Health Partners, a cardiovascular health services platform; DeliverHealth, a provider of professional and tech-enabled services designed to simplify EHR, revenue cycle and patient engagement complexities for health systems; and Clear Health Strategies, a tech-enabled payor services platform designed for managing non-standard medical claims. Sverica International Founded in 1993, Sverica pursues control and minority equity through a range of investment sizes. The firm is flexible in its investment size. | 2:00PM ET, $135 million financing for Amylyx Pharmaceuticals, Pfizer, Bain Capital launch neuroscience company backed with $350M, Blackstone caps off private equity's largest-ever life sciences fund, Biogen, citing insurance challenges, shutters one of its Aduhelm studies, Drug deals, launches in focus as pharma earnings begin, Novartis asks FDA to approve biosimilar for Biogen's top-selling MS drug, 'Flat is the new up': After biotech correction, venture investors turn to safer bets, Epigenetic editing: a tunable CRISPR alternative, Sarepta to ask FDA for accelerated approval of Duchenne gene therapy, Decentralization: The Evolution of Clinical Trial Design, Optimizing Engagement: How To Plan Successful Meetings and Events in Biopharma Today, The latest developments in oncology research, Biden Administration Plans to Offer Updated Booster Shots in September, Califf warns of dangers of user fee brinkmanship, This billionaire has quietly driven Bostons biotech industry for decades, Build An Effective Drug Discount Management Program for Your Organization, Addressing Personalized Medicines Complexity Problem: Examples from Parkinsons Disease, 2022 PDA Rapid Microbiological Methods Workshop, Focus on genomic innovation, not on undifferentiated heavy lifting, Innovate with tools and solutions purpose-built for life sciences organizations, Concert to seek approval for hair loss drug after second study success, Alnylam reveals longer wait for anticipated drug trial results, Novartis-linked startup launches with technology designed to remove destroy tags on helpful proteins, Boston-based investment firm Bain Capital has raised $1.9 billion in a new fund directed at pharmaceutical, biotechnology and medical device companies. McGuireWoods Healthcare Private Equity Team. Shore supports management partners with capital, business development expertise, and industry knowledge to accelerate growth, fund acquisitions, and generate value to shareholders.  Webster Equity Partners (Waltham, Mass. Included in its portfolio is MetaSource, a provider of technology-enabled business process outsourcing services with a focus on the healthcare, financial services and retail industries. It seeks control equity through a variety of investment sizes.

Webster Equity Partners (Waltham, Mass. Included in its portfolio is MetaSource, a provider of technology-enabled business process outsourcing services with a focus on the healthcare, financial services and retail industries. It seeks control equity through a variety of investment sizes. /https://blogs-images.forbes.com/thumbnails/blog_1277/pt_1277_9989_o.jpg?t=1355202602) The firm targets companies within healthcare and more than a dozen other industries.

The firm targets companies within healthcare and more than a dozen other industries.